7 Easy Facts About Cheap Chapter 13 Bankruptcy Lawyers Md Described

When you file your official bankruptcy forms with the court clerk, you’ll pay a bankruptcy filing fee and present a certificate demonstrating that you received the mandatory credit counseling education from an agency approved by the United States Trustee's office. The session helps evaluate whether you have sufficient income to repay your creditors.

You should expect to pay a fee of between $25 and $35 per course because while providers must provide counseling for free or at reduced rates if you cannot afford to pay, Chapter 13 filers rarely qualify for the discount. You’ll find a list of approved credit counseling and debtor education agencies on the U.S.

The central part of your Chapter 13 case is the repayment plan that you’ll propose to your creditors and the court. Amongst other things, the plan must take into account each of your debts. You’ll use either the official plan form or your court’s local form, depending on where you file. chapter 13 bankruptcy lawyers baltimore MD.

Facts About Chapter 13 Bankruptcy Lawyers In Md Uncovered

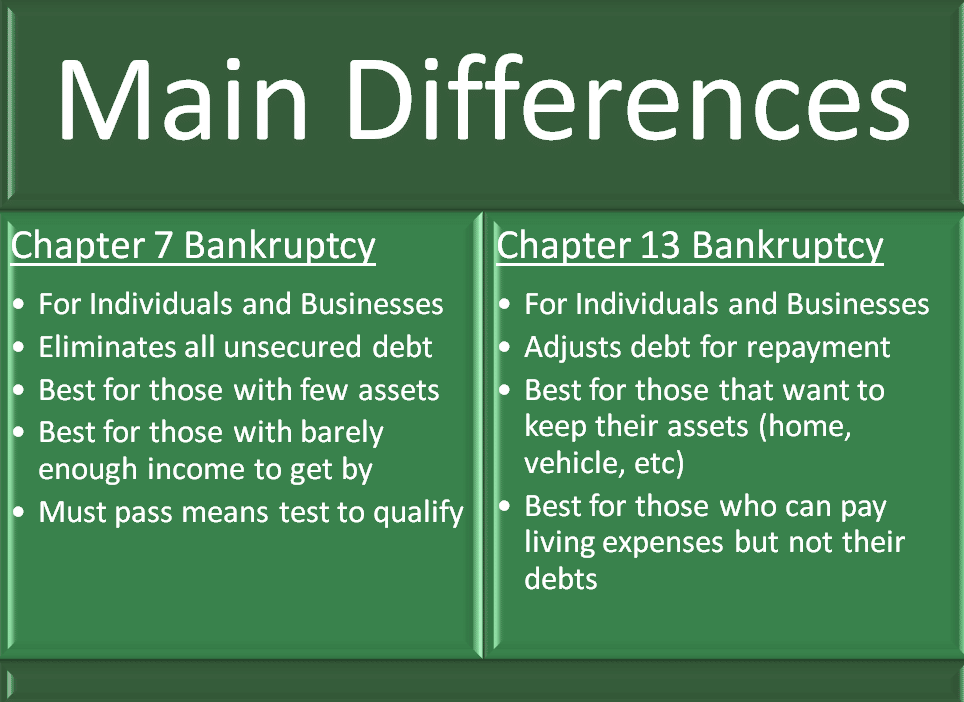

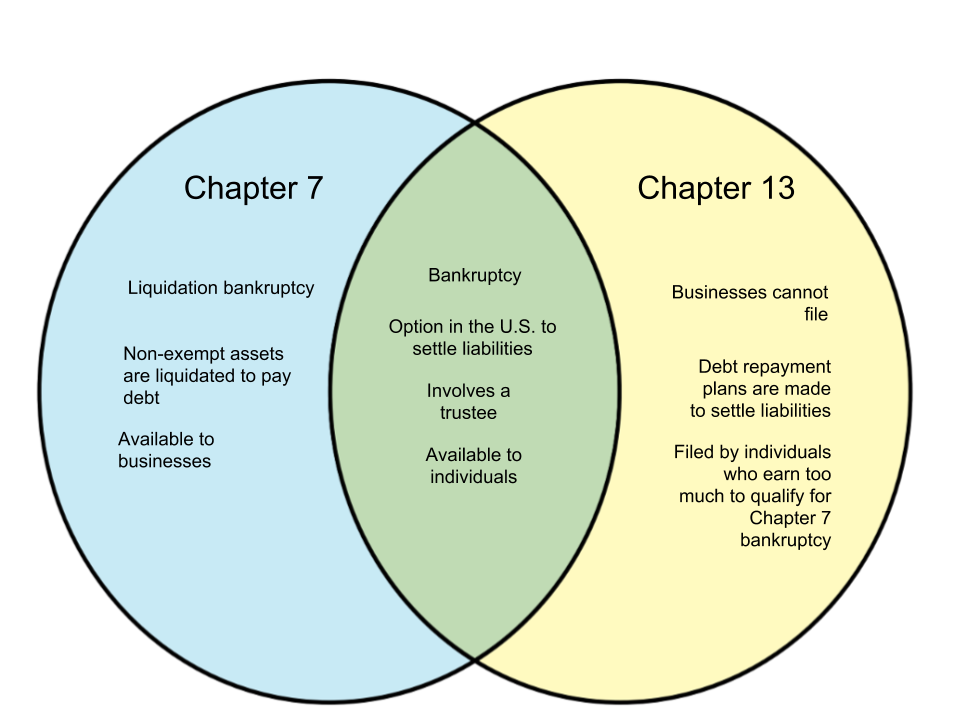

If you’re able to make changes to everyone’s satisfaction, the court will likely approve (confirm) your plan at the confirmation hearing. You won’t wait until plan confirmation to start paying your monthly payment, however. Your payments will begin the month after you file. The various bankruptcy chapters provide a filer with two types of bankruptcy relief: liquidation and reorganization.

By contrast, in a Chapter 11 or Chapter 13 reorganization, the trustee doesn’t sell the debtor’s property. Instead, the debtor must develop a plan to repay creditors over a period of time. Most plans will include provisions that allow the debtor to pay creditors less than the amount owed. Before the plan goes into effect, the bankruptcy court must approve or “confirm†it at a confirmation hearing.

If there are no objections, the judge will confirm the plan if it meets the following elements: the plan is feasible (for instance, the debtor has enough income to pay the creditors as provided) the debtor proposed the plan in good faith (the debtor isn’t trying to manipulate the bankruptcy process), and the plan complies with bankruptcy law - Maryland chapter 13 bankruptcy lawyers.

Maryland Chapter 13 Bankruptcy Lawyers - Questions

By contrast, discharge of debt is immediate after a Chapter 11 confirmation. The confirmation creates new contracts between the debtor and creditors. Both Chapter 11 and Chapter 13 cases can be difficult to complete successfully. Debtors in Chapter 11 cases must be represented by an attorney. Although it’s possible to represent yourself in a Chapter 13 case, doing so is rarely successful, and most courts encourage filers to retain counsel.

Your Chapter 13 plan must pay certain debts—called priority claims—in full. Priority claims include child support and alimony arrearages, and most tax obligations. If you want to keep a car or house, you’ll have to continue to pay your regular payment on the car loan or mortgage. Whether you’ll have to pay these amounts as part of your plan will depend on your local court.

The plan must apply your disposable income (the amount remaining after paying secured and priority debt, as well as allowed living expenses) toward unsecured debts, such as credit card balances and medical bills. You don't have to fully repay these debts, or even pay them at all, in some cases.

Some Known Details About Chapter 13 Bankruptcy Lawyers Baltimore Md

You’re allowed to keep all of your property in a Chapter 13 bankruptcy if you can afford to do so. You’ll have to pay the value of any property that you can’t protect with an exemption through your plan. Although the repayment length will depend on how much you earn, most filers will have a five-year plan.

Even so, because the monthly payment will often be significantly lower over five years, it’s common for filers to opt for the more extended plan—primarily because it increases the likelihood that the court will confirm the plan. (For more on repayment plans, see The Chapter 13 Repayment Plan.) A lot of financial changes can occur over the course of your plan (Maryland chapter 13 bankruptcy lawyers).

If, for example, your income decreases, you might be able to modify the amount being paid to your unsecured creditors. If, however, you can’t pay a required debt, the court might let you discharge your debts due to hardship. Examples of hardship would be a sudden plant closing in a one-factory town or a debilitating illness (chapter 13 bankruptcy lawyers baltimore MD).

4 Simple Techniques For Chapter 13 Bankruptcy Lawyers Baltimore Md

Keep in mind, however, that there’s a good chance that you’d lose your nonexempt property. The other option is to dismiss your Chapter 13 bankruptcy case. The downside to this approach is that you would still owe your outstanding debt balance, plus any interest creditors didn’t charge during your Chapter 13 case.

If you meet all requirements, the remaining balance on qualifying dischargeable debt gets wiped out. You should be debt free except for a mortgage or student loan if you have one.

How much you must repay depends on the types of debt you have. Here are the general guidelines: You must pay 100% of the bankruptcy filing fees, trustee commissions, and your bankruptcy attorney's fees. You must pay 100% of the following debts: child and spousal support arrears owed to the parent or child; most tax debts except those first due at least three years prior to your bankruptcy filing; wages, salaries, or commissions you owe to employees up to a certain limit; and contributions you owe to an employee benefit fund.

The Single Strategy To Use For Chapter 13 Bankruptcy Lawyers Baltimore Md

You also have to pay 100% of debt secured because of a tax lien. This is the wild card category. You will pay anywhere between 0% and 100% of the amount you owe, depending on your disposable income, the length of your repayment plan, and the total value of what your creditors would have received had you filed under Chapter 7 bankruptcy.

To learn more about what you must pay in a Chapter 13 bankruptcy, see Nolo's article Your Obligations Under a Chapter 13 Bankruptcy Plan.

john orcutt bankruptcy attorney sears declares bankruptcy best chapter 7 lawyer near me